OLED TV business that LG Electronics ambitiously prepared for is remaining at a standstill for more than 2 years. Korean media is reporting that the OLED TV sales in Korea reached 3,000 units per month, but this figure is too weak.

The money that LG Display have invested in line establishment for OLED panel for TV is already exceeding approx. US$ 1,400,000,000. Annual depreciation cost for equipment investment alone, excluding cost of labor and material, is approx. US$ 280,000,000.

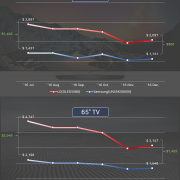

Considering the current cost for FHD OLED TV is approx. US$ 1,800 – 3,300, monthly sales of 3,000 units in Korea only result in approx. US$ 9,400,000. With approx. 10,000 units per month being sold in the world, monthly revenue is merely US$ 23,000,000.

Although LG Display is aiming for 600,000 units of OLED panel for TV shipment this year, with LG Electronics’ first quarter world OLED TV sales of approx. 30,000 units, there is concern that only 100,000 – 200,000 units will be sold in 2015.

It is difficult to understand whether this uncommonly low sales of LG Electronics’ OLED TV is because they are not selling them or unable to sell them.

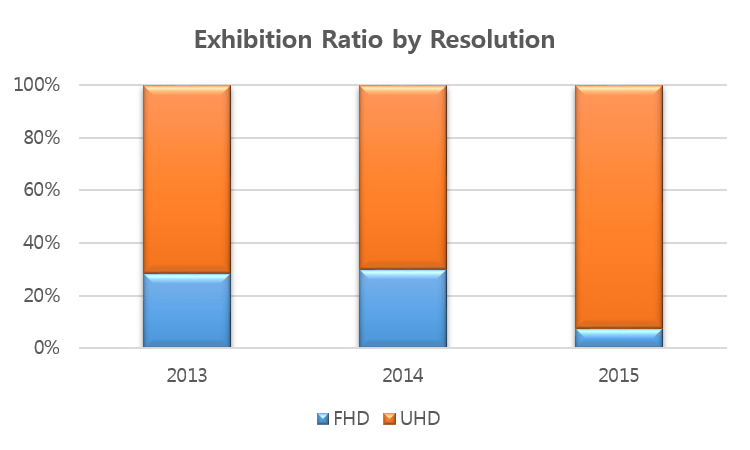

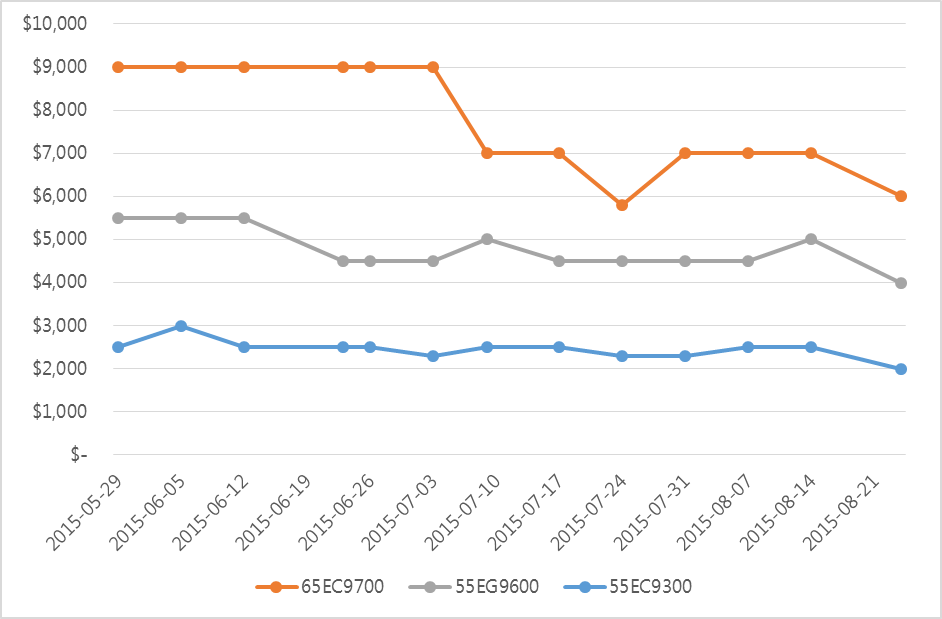

It seems plain that the initial price of OLED TV in 2013, approx. US$ 14,000, was set in order to not sell. LED TV at the time was being sold at approx. US$ 2,800, and the 5 times more expensive price was too high to be considered a normal premium price. Consequently, the 2013 OLED TV market stopped at around 10,000 units, and in 2014 remained around 100,000 units.

At this point, feasible production rate for LG Display’s 55 inch FHD OLED panel needs to be compared. In 2013, LG Display’s M1 line yield rate was approx. 40% with annual possible production of 50,000 – 100,000 units. As the yield rate increased to 80% in 2014, it is estimated that 200,000 units or more would have been produced.

Compared to LG Display’s investment cost and production potential, the LG Electronics’ OLED TV sales results are too shabby.

Of course, as the current main product on the market is FHD, when the newly released UHD OLED TV market actively opens the figures could always change. However, with 55 inch UHD OLED TV having to compete with Samsung Electronics’ SUHD TV, the market is not so easy. SUHD TV costs approx. US$ 3,700, and UHD OLED TV costs about 25% more with US$ 5,100.

Compared to the initial price of FHD OLED TV, approx. US$ 14,000, 2 years ago the UHD OLED TV price is low enough to be quite reasonable. However, with the performance of past 2 years it appears that LG Display might be inadequate to widely open the OLED TV market.

It makes one wonder how Samsung Electronics became the world leading company with their OLED panel equipped Galaxy series achieving 20% mobile market share, a market that used to be dominated by LCD panel.