Just What is QLED…2019 QLED Mass Production is Garbage?

Barry Young Suggested “Don`t Believe the Garbage about QLED in 2019” (Source = Samsung)

Hyunjoo Kang / jjoo@olednet.com

An article by Barry Young, the managing director of the OLED Association, in Display Daily created much excitement in Korean display industry when domestic media picked up the story on 14 June. The article includes Young’s suggestion, “don’t believe the garbage about QLEDs in 2019”.

Clarifying this comment, experts unpack this to mean Young’s pessimistic outlook for QLED mass production in 2019 forecast rather than for QLED itself.

Barry Young discussed QD in an article titled Drinking the QD Kool-Aid in Display Daily. It is estimated that the comment is aimed at the recent speculation that Samsung Electronics will mass produce QLED TV as the next generation product in 2019 rather than OLED TV. While Samsung Electronics has not announced their official position regarding QLED TV mass production timing, some sectors within the market believe it will be possible by 2019. However, many have differing opinions.

QLED is a display that uses quantum dot for emitting layers’ host and dopant while maintaining the common layers used in the existing OLED. Quantum dot, emitting layer materials used in QLED, utilizes inorganic materials and can lower the production cost in comparison to OLED’s emitting layer materials. That the process does not require evaporation as it can be carried out through ink jet printing is another advantage, and some also believe that QLED color purity is superior to OLED.

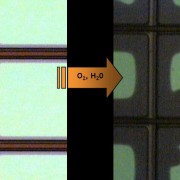

Despite these, some experts point out that it is difficult for QLED to become the main force of the premium TV market, surpassing OLED, in a short time. QLED has to solve several technological issues including lifetime and emitting efficiency. When mass producing QLED, pin holes occur and reduce device lifetime, and as the hole and electron are not balanced the emitting efficiency falls. Furthermore, as even research has not been carried out regarding QLED lifetime and degradation, whether it will be commercialized by 2019 is also in question.

Meanwhile, Young refuted the argument that QD-LCD’s picture quality is superior to OLED. He proclaimed that QD Vision and Nanosys are making “very questionable statements” about how “OLED TVs were outperformed by LCD’s with QD enhanced LED backlights” without considering merits of OLED such as contrast ratio, viewing angle, response time, color accuracy, and form factor as well as luminance and color area.

![150202_[Analyst Column] CES2015에서 보여준 TV의 종착역은 명암비](http://olednet.com/wp-content/uploads/2015/02/150202_Analyst-Column-CES2015에서-보여준-TV의-종착역은-명암비.png)