Following smart phone, other devices equipped with display such as tablet PC, monitor, and TV are mostly using OLED panel. In turn, LCD is attempting to replicate key points of OLED panel to catch up.

The first is LTPS TFT technology. When Samsung Display started producing AMOLED using LTPS TFT, it was overlooked by the LCD sector as it financially needed twice the amount of investment compared to a-Si TFT technology and therefore thought it to have no business value. However, as the smart phone resolution is getting higher, LCD companies are also employing LTPS TFT that has high mobility.

The second is the ultra slim thickness of OLED panel that does not have BLU. To answer the smart phone’s need for a thin body with light weight, LCD is thinning the panel by slimming the glass substrate further and further. Nowadays, even TV sector of LCD is busy trying to become thinner. In CES2015, Sony exhibited ultra slim LCD TV with thickness of approximately 4.9mm.

<CES2015, Sony Floating Style 65” UHD LCD TV>

<CES2015, Sony Floating Style 65” UHD LCD TV>

The third is curved design. LG Elec. and Samsung Elec. exhibited curved OLED TV using thinness of OLED panel in CES2013. With the products on the market, LCD TV also reduced thickness and began selling curved LCD TV.

<CES2015, Hisense Curved LCD TV>

<CES2015, Hisense Curved LCD TV>

Hisense, a Chinese brand, exhibited LCD TV with curved design in CES2015. Samsung Elec. decided that the main product of 2015, SUHD LCD TV, will have curved design, as well as releasing a curved LCD monitor. However, despite reducing the thickness LCD cannot yet be applied to smart phones.

The fourth is color reproductivity rate. The existing LCD TV can only produce approximately 80% of NTSC standard, which is limited compared to 110% of OLED. LCD sector criticized OLED’s color reproduction to be excessive; however, they recently developed new technology of applying quantum dot materials onto BLU and launched the sales of LCD TV with almost 120% of NTSC. Furthermore, it is deceiving the public by calling the QD BLU LCD TV as Quantum Dot TV packaged as a non-LCD TV.

<CES2015, TCL QD BLU LCD TV>

<CES2015, TCL QD BLU LCD TV>

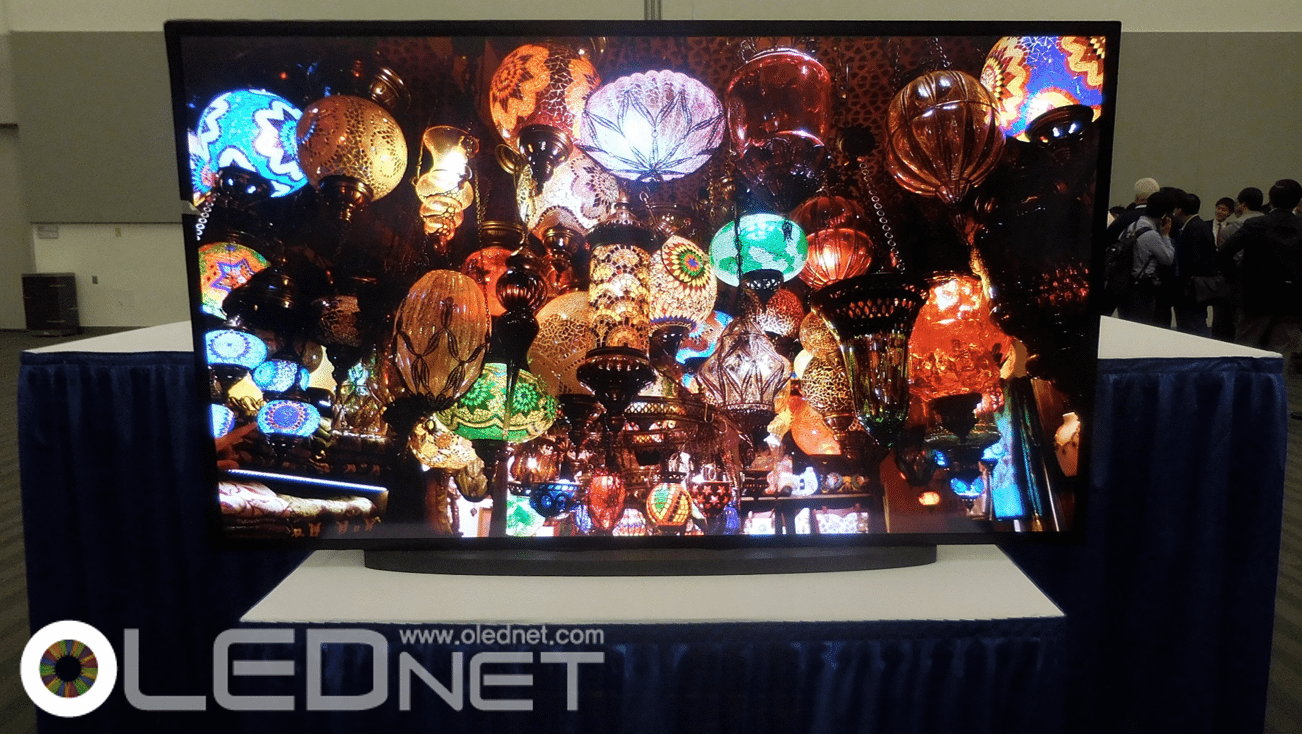

The fifth is contrast ratio. OLED TV’s contrast ratio is close to infinite with 1,000,000:1. Compared to this, LCD TV’s contrast ratio was 1,000:1, and unable to showcase dark scenes. Recently, HDR (high dynamic range) technology that brightens bright scenes and darkens dark scenes is strengthening its contrast ratio. Sony is striving to achieve high contrast ratio for LCD TV, similar to OLED TV, and exhibited HDR technology applied BRAVIA in CES2015.

<CES2015, Sony HDR applied LCD TV>

<CES2015, Sony HDR applied LCD TV>

Many key points of OLED such as previously mentioned thickness, contrast ratio, and curvature ratio still need to be improved by LCD panel, and diverse attempts are continually being made to catch up to OLED panel that is entering the market with great strength. However, LCD cannot yet even attempt to match OLED on high speed response time that is needed for programs with fast action such as sports.

OLED holds diversity in color definition and design, and even if LCD keeps on reaching for these characteristics, LCD will remain LCD and will not be able to overtake OLED.