Q1 New OLED Product, Smartphone·Wearable Rapid Increase…LG Maintains TV Monopoly

Galaxy S7 edge ( Source = Samsung )

Hyunjoo Kang / jjoo@olednet.com

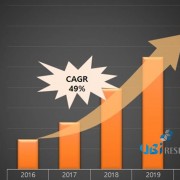

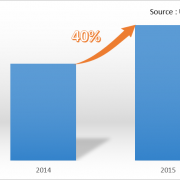

Of the new OLED display equipped products released in Q1 2016, smartphone and wearable products significantly increased compared to the same period in 2015. However, for OLED TV sector, no news was reported in Q1 other than LG Electronics’ new product.

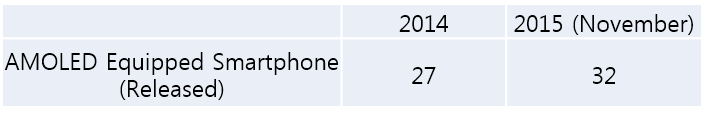

According to UBI Research, 17 new OLED equipped smartphones were released in Q1 2016. This is 4 more than Q4 2015, and 12 more than Q1 2015. Of these, Samsung Electronics released 4 smartphones including Galaxy S7 and S7 Edge, responsible for the largest proportion. Following Samsung, ZTE, Gionee, Acer, and BLU each launched 2 OLED smartphones, and Vivo, HiSense, Konka, HP, and Microsoft released 1 each. Of the companies, 6 are from Greater China Region.

For OLED equipped wearable new products, 7 were released in Q1, 2 more than Q4 2015, and 4 more than Q1 2015. Sony, Oculus, HTC, and Sulon released new VR products. Epson released smartglasses, and Fitbit and Intex released smartbands. OLED wearable market showed much activity in Q2 2014 with over 20 new products centering around smartwatch and smartband products, which quietened down since then. However, with recent new releases of VR and smartband devices, the market is being rejuvenated.

LG is still dominating the OLED TV market. LG Electronics was the only company to release new OLED TV in Q1, and released 4 products in 55 inch – 77 inch. The market showed some movement in Q1 2016 when several Chinese companies, including Haier and Changhong, released OLED TV. However, since then the market, except for LG, has been quiet. This is analyzed to be due to high price of large area OLED panel, panel supply shortage, etc. In Q2, China’s Skyworth released a new product but the sales are known to be less than anticipated.

One expert explained that large area OLED still have issues that need to be solved compared to small OLED including price competitiveness. He added that latecomers such as Chinese companies are slow to select OLED for TV compared to smartphone.

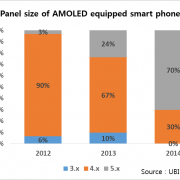

![150216_[Analyst Column] AMOLED 탑재 스마트폰이 모바일용 디스플레이 대형화 주도_eng](http://www.olednet.com/wp-content/uploads/2015/02/150216_Analyst-Column-AMOLED-탑재-스마트폰이-모바일용-디스플레이-대형화-주도_eng.png)