Samsung’s Galaxy S6 and Galaxy S6 Edge

On July 30, Samsung Electronics announced their second quarter earnings results and future outlook via conference call.

The sales of IM (Information Technology and Mobile Communications) department recorded approximately US$ 13,000,000,000, a 1% increase from the previous quarter. The business profit of approximately US$ 2,000,000,000 was recorded, an increase of US$ 17,000,000.

Although the overall sales increased through Galaxy S6 release, due to the supply issues of Galaxy S6 Edge, and increase in marketing cost, the business profit did not much increase. Samsung Elec. explained that due to the decrease in sales of low-mid-price old models, degrowth was shown compared to the previous quarter. However, ASP was much improved due to product mix development.

Robert Yi, chief of the firm’s investor relations team, revealed that 89,000,000 units of mobile phones and 8,000,000 units of tablets were sold in the second quarter. The ASP of these products recorded mid US$ 200s. Of the mobile phone sales, the percentage of smartphone sales was in low 80s.

Yi announced their plan to increase the market share through flexible price strategy for Galaxy S6 and S6 Edge in the second half and strengthening of low-to-mid price smartphone line up. He also mentioned that enlargement of display size and AMOLED panel use could occur for future lower priced items.

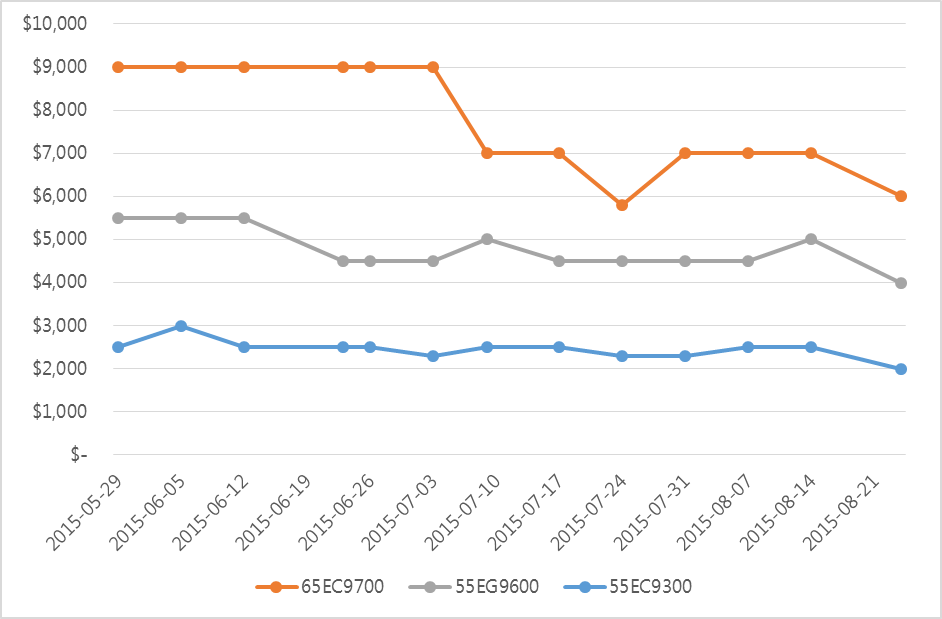

The price of Galaxy S6 Edge that exceeded US$ 1,200 initially, recorded US$ 739 in the second week of July. If the currently operational A3 line yield improves and investment for transforming part of rigid A2 line to flexible occurs, flexible AMOLED panel’s mass production capa. will increase from the second half. This will simplify AMOLED panel supply process, and it is analyzed that the flexible price strategy for Galaxy S6 and S6 Edge will be feasible.

For the display section, it was revealed that the results were slow compared to the previous quarter due to increase of cost from new flexible display line ramp up and decrease in smartphone demand. Samsung Elec. explained that in the second half, they are planning to increase the market leadership through flexible technology improvement. The new growth power will be achieved through development of new applications such as transparent, mirror, and head mounted display.

Samsung Elec. revealed that there was difficulty in acquiring initial supply regarding the Galaxy S6 Edge. They explained that this was due to the use of new technology, including the large area evaporation technology of A3 line that began operation in April this year. However, the problem has now been solved and reliable supply is possible, and the firm revealed the possibility of supply of flexible OLED panel to external companies. The panels will be supplied to meet the needs of client and market, and some capa. establishment will also occur next year. Product performance and production cost competitiveness are improving, and the firm revealed strategy of increasing the OLED panel sales to external companies this year.

During this conference call, Samsung Elec. revealed that the total sales was recorded to be approximately US$ 41,000,000,000 in second quarter of this year which is a 3% increase compared to the previous quarter. The business profit recorded approximately US$ 6,000,000,000, an increase of 15% compared to the previous quarter.