UDC、BASFの有機ELりん光材料の特許を9600万ドルで買収 …やはり材料界の特許の帝王

Source = UDC

Hyunjoo Kang / jjoo@olednet.com

有機EL材料業界で特許の帝王として君臨しているユニバーサルディスプレイ(UDC)が、ビーエーエスエフ(BASF)の有機EL関連の特許を米ドル約9,600万ドルで買収したと28日発表した。

この特許ポートフォリオは、主に有機ELりん光材料に対するもので、既に出願された500件を超える特許とまだ出願前の86件の特許も含む。BASFのこの有機ELポートフォリオは、平均で10年間有効である。

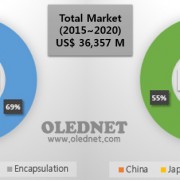

UDCは、今回のBASF社の特許買収により、ブルー発光システムを開発するために役立つことを期待している。今回の買収でUDCは、4,000件を超える出願特許と待機中の特許を保有することになる。UDCは、米ドル3億9,570万ドルの現金を持っており、今回のIP買収の費用は十分に可能である。

今回のUDCの動きは、韓国の有機EL発光材料メーカーも注目している。有機EL材料市場は、特許競争力が左右するので、十分なIP確保が重要だからである。

UBIリサーチの調査によると、UDCは、このような特許競争力を前面に出して、2015年は前年に続いて、世界の有機EL発光材料市場で1位を占めた。徳山ネオルックスなど、韓国の材料メーカーは、UDCの強固な市場の先取りに対抗して、特許競争力の確保に積極的に乗り出している。

成均館大学高分子工学部イ・ジュンヨプ教授は、4月に開かれたフォーラムで、「UDCの特許は、これまで訴訟を経てやや縮小された部分もあるが、いまだりん光材料がほとんどすべて含まれる広いクレームを持っている」とし、「UDCは別の特許を買収するなどの対応に乗り出し、韓国メーカーもこれに対する対応策を探さなければならない」と強調した。

一方、BASFは、2015年には有機EL関連の研究開発を中断している。