On July 29, LG Electronics announced its earnings results at LG Twin Towers in Yeouido, South Korea. Representatives of each business departments, including LGE’s CFO Jung Do Hyun, explained the second quarter results and third quarter outlook.

Regarding the poor sales results of this quarter, LGE gave the decrease in sales and business profit in most of the growth market as the reason. The decrease was analyzed to be from sudden fluctuations in foreign exchange rate which led to global economic downturn. Essentially, it seems LGE believes that their market strategy is not at fault and that the decrease in demand in TV market and weaker global foreign exchange rate led to the fall in profit.

The competitiveness of Home Entertainment (HE) business department increased through strengthening product mix focusing on premium products. However, due to the sudden fluctuations in foreign exchange rate and seasonal factors the global market diminished and an 11% decrease in sales was recorded compared to the previous quarter. Jung explained that the sales in Europe, Central and South America, and Russia increased but most of the growth market showed economic downturn due to weak foreign exchange rate which led to the decrease in sales. However, he forecast that in the third quarter, the premium TV market will continue to grow and increase the UHD OLED TV sales.

Additionally, Jung commented while low-to-medium priced products will be released, sales activity will focus on premium products and announced as the yield of UHD OLED TV panel is increasing rapidly, they will be able to compete in price from mid-2016. He also made a positive estimation that the market will show a growth rate once the foreign exchange rate fluctuations stabilize.

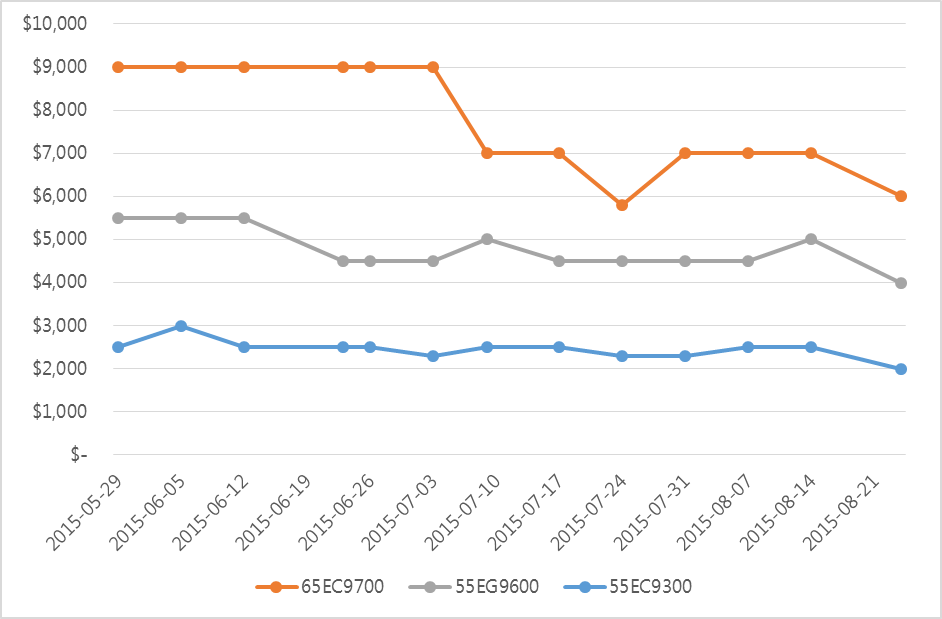

According to UBI Research, there is approximately US$ 2,000 prices difference between UHD OLED TV and SUHD TV, looking at 55inch size in early July. Within less than a month, on July 24, the difference was reduced to US$ 1,700; it is estimated that UHD OLED TV will be able to compete against SUHD TV price from next year.

Answering a question on competition with Chinese companies, LGE clarified that although their growth is rapid, LGE is ahead in terms of patents, quality, and brand power. Although they mentioned that Chinse companies have growth foothold with their large market share within domestic market in China, LGE concluded that the real global growth is not very great. However, LGE admitted that Chinse companies are definitely superior in cost effectiveness. To combat this, LGE announced they will focus on premium products and increase competitiveness, and form strategy of supplying non-premium products to the growth market.

LGE recorded sales of approximately US$ 1,600,000,000, a 0.5% decrease from the previous quarter, and business profit of approximately US$ 200,000,000, a 20% decrease from the previous quarter.