LG Display Reveals Confidence in OLED

On October 22, LG Display emphasized their conviction in large area OLED and plastic OLED once again when announcing the performance results held in LG Twin Towers. LG Display revealed that their future business will be OLED and will lead the market through OLED.

LG Display’s CFO Sang-don Kim announced that OLED is the top priority in terms of portfolio, and regarding display’s future direction, explained that there is new momentum through automotive, IoT, and commercial display. He also added that the sales did not quite meet what was estimated earlier this year but it is on proper track.

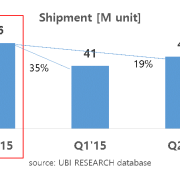

LG Display is estimating 400-500 thousand units of OLED TV panel shipment for TV and aiming for 1 million units next year. Regarding the poor sales, he gave trial errors in new technology development, which was the main focus, as the reason. LG Display will plan optimized investment after market trend consideration.

In 2015, 55inch or larger panel for TV occupied 8% of the shipment, but the target is gradually increasing it to 20% or higher. LG Display highlighted TVs are becoming larger at a fast pace; 65inch and 77inch OLED TV, rather than what was expected to be the main product 55inch, showed higher than expected sales. Kim explained that to maximize production cost reduction of OLED panel, they are internally adjusting material cost and yield. He also forecast that the demand will increase through production increasing projects.

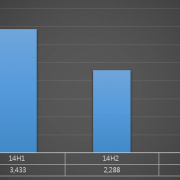

LG Display recorded 7,000 million USD* of revenue in 2015 Q3. This 7% increase compared to its previous quarter is due to the increase of shipment area through TV’s panel size increase and success of product mix. Business profit fell by 32% compared to previous quarter with 300 million USD*. LG Display revealed they will push for profit improvement through inventory level management and operation rate adjustment. They also reported they will strengthen competitiveness through synergy with OLED lighting business and showed anticipation for future.

* 1 USD = 1,100 KRW