[SID 2016] JDI CTO “LCD isn`t Suitable for Flexible”…Emphasizes ‘Human Friendly’

a Slide from JDI Hiroyuki Ohshima CTO`s Keynote (San Francisco =OLEDNET)

Hyunjoo Kang / jjoo@olednet.com

CTO of JDI , Hiroyuki Ohshima, estimated that the display will evolve to flexible and human friendly, and emphasized that LCD is not suitable for flexible

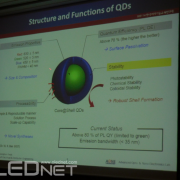

During his keynote session in SID 2016 (22-27 May), Ohshima discussed the future of display. He explained that the display will evolve to System Integrated Display that combines different technologies and toward flexible.

Display is expected to become more interactive with human body. Beyond touching the screen with fingers, biological signals will be recognized such as heartbeat, eye gaze, fingerprint, and palm print. Through these, display will evolve into an input device that moves deeper into people’s lives.

For these to become a reality, Ohshima explained that diverse technologies such as touch, recognition, security, health care function, pen input need to be applied to the display. He stressed that display is heading toward flexible and noted LCD’s limitation regarding this issue.

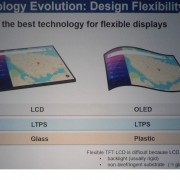

Ohshima told the attendees that as LCD requires backlight and glass substrate is used, it is not suitable to actualize flexible panel. For OLED, it is expected to move forward to flexible and foldable exceeding ultra-thin and curved. However, he added that OLED still has several issues that need to solved including not being able to follow LCD in terms of pixel density.