UBI Research、2017 OLED光源採用動向及び市場レポート発刊 : LG Display、照明用OLED光源の本格的な量産開始による市場開花期待

■ LG Displayは、9月末から第5世代照明用OLED光源の量産を開始

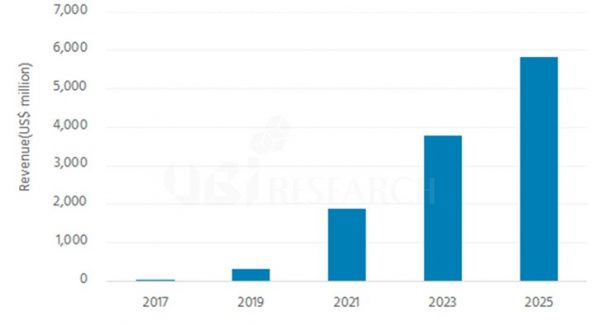

■ OLED光源市場は、2021年に約19億米ドル、2025年には約58億米ドル規模まで拡大

韓国LG Displayは、9月末から第5世代照明用OLED光源の量産を開始する予定で、OLED照明市場が本格的に開花できるかに注目が集まっている。LG Displayによると、月産規模は15,000個で、今後は90,000個まで生産可能な設備が整う。

UBI Researchが発刊した『2017 OLED Lighting Annual Report』では、世界のOLED光源市場は、2020年から大きく成長し、2021年には約19億米ドル規模になると見込まれている。また、2017年から2025年まで年平均85%の成長を見せつつ、2025年には58億米ドル規模になると予想されている。

OLED光源は、薄くて軽くてた柔らかなパネルを実現できるため、設置スペースの制限がなく、デザインの自由度が高い。また、発熱とフリッカー(Flicker)現象が少なく、安らかな雰囲気を作ることができるため、一般的な室内照明のみならず、車、展示、医療向けにもOLED光源が採用されている。

しかし、OLED照明市場はモバイル機器とTVに積極的に採用中のOLEDディスプレイ市場と比べ、成長が遅い傾向がある。ドイツOsramは主に車載用OLED照明向けの開発に集中しており、オランダPhilipsはOLED照明事業部を米国OLEDWorksに売却した。また、住友化学とコニカミノルタなど、日本のパネルメーカーも産業や医療用、その他の様々な分野に採用可能なOLED照明を開発しているものの、大きな成長は期待できなかった。

今回LG Displayによる第5世代OLED量産ラインの稼働開始で、照明用OLED光源の価格は100x100mmを基準に10米ドル以下まで下がると期待されている。また、室内照明だけではなく、車載用照明、展示用照明など、様々な分野に採用される見込みで、成長が遅いOLED照明市場に活力を与えられるかに期待が集まっている。

UBI Researchは、LG Displayが世界の照明用OLED光源市場全体に占める割合は、2017年に約70%、2020年には約50%となり、OLED光源市場をリードし続けると予想した。

『2017 OLED Lighting Annual Report』には、次世代照明市場の動向と有望アプリケーションの分析、LG Displayの投資によるOLED光源コスト分析、OLED光源市場展望などに関する記述が含まれている。特に、OLED光源市場展望とOLED光源用発光材料市場展望、OLED光源用材料及び部品市場展望、OLED光源用装置市場を様々な観点から分析したため、関連企業がOLED照明市場を把握する上で参考になると期待されている。

<OLED光源市場全体の売上高展望 >