Hyunjoo Kang / Reporter / jjoo@olednet.com

Flexible OLED from LGD(CES 2016)

From April, the display industry is estimated to start mending the damage carried out by LCD with OLED.

In Q1 2016, Korean display industry suffered due to oversupply of Chinese LCD panels. Market experts believe that Samsung Display and LG Display will announce large Q1 deficit in April due to LCD.

However, the display market is expected to actively improve its performance from April.

Dong-won Kim, analyst with Hyundai Securities, estimated that great increase in profit is expected from Q2 2016 due to the increase in OLED operation rate and yield improvement. Also because of profitability improvement effect following LCD panel’s price rebound, the deficit will decrease.

LG Display’s performance in OLED sector is expected to noticeably improve. Over 90% of LG Display’s total mass production line is LCD at present. Hence, the fall of LCD price in Q1 is expected to have hit hard and OLED business is also showing deficit.

OLED TV from LG(CES 2016)

◆ After Harsh Q1, Warm Breeze of OLED… Spring for Equipment Industry Too

However, this will change from Q2. Analyst Hyeoncheol So of Shinhan Investment forecast that LG Display’s OLED TV sales volume and revenue in Q2 2016 will increase by 144% and 106% respectively. He added that the business deficit of OLED TV sector will greatly decrease.

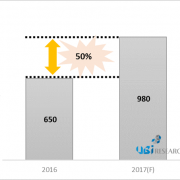

LG Display is anticipating that the deficit will turn to profit in H2 2017, with the business profit of up to 1 trillion KRW in 2017, an increase of 115%.

Samsung Display, whose LCD and OLED ratio is 50:50, is expected to show 900,000 million KRW in deficit in LCD sector this first quarter. However, this is estimated to be compensated to some degree by the profit in OLED.

Samsung Display and LG Display are actively carrying out investment in OLED panel mass production line in Q1. As well as the investment in turning the existing LCD line to OLED, investment in new OLED line establishment is actively being carried out.

As such, with the optimistic outlook on OLED within the display market, flexible OLED manufacturing equipment companies such as Tera Semicon, Viatron Technologies, and Dong A Eltek had been discussed as the favorites of securities companies. In fact, Samsung Display’s flexible OLED manufacturing equipment related key collaborator AP Systems showed remarkable growth recording 12,100 million KRW in business profit last year.

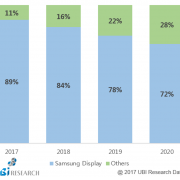

UBI Research forecast that Korean companies will strengthen their dominance with their 2016 AMOLED shipment’s 95% occupancy of the global market. As OLED is becoming stronger in the TV, smartphone, and VR market, this will become a huge growth engine for global panel companies such as Samsung and LG.