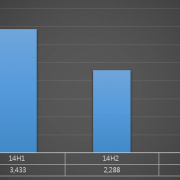

Minus Growth for H1 OLED Material Market with Mere US$ 564 Million*

According to UBI Research, the 2015 H1 OLED material market recorded approximately US$ 564 million; this is a 14% increase compared to 2014 H2, but a 24% decrease against 2014 H1.

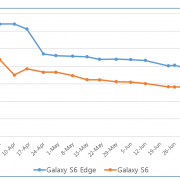

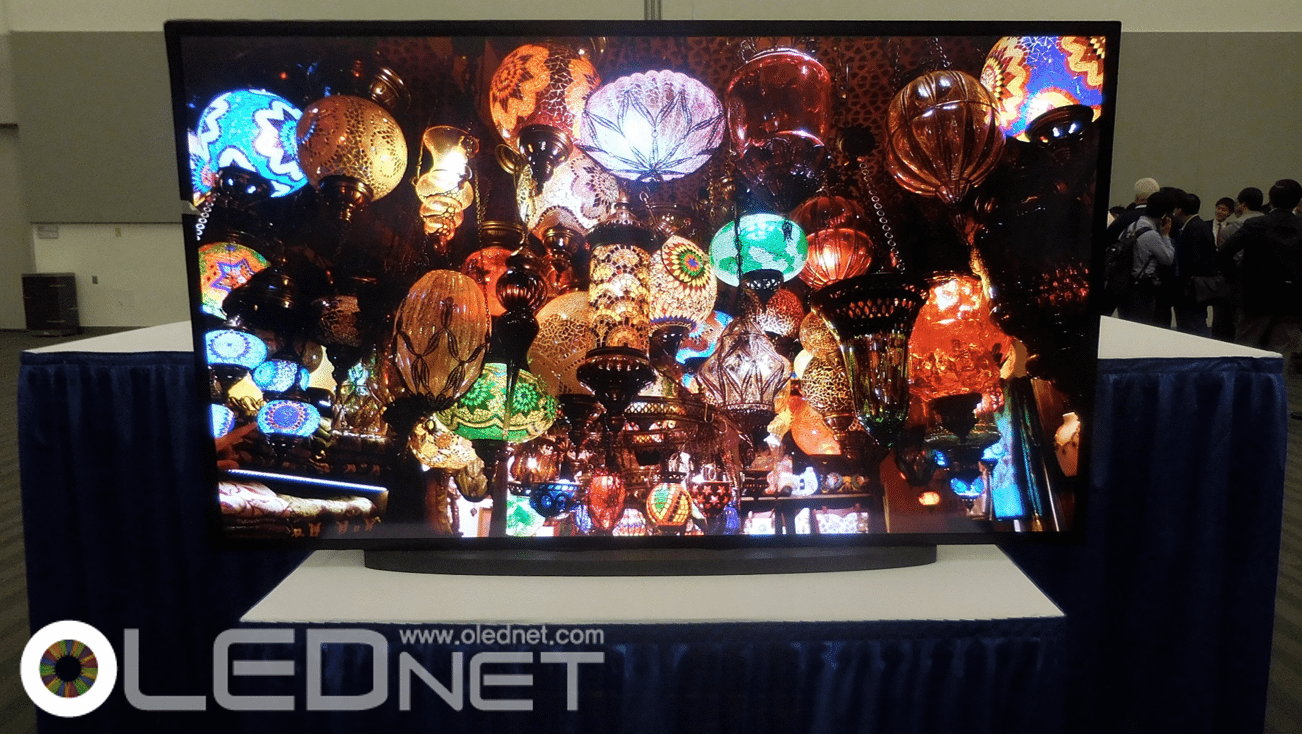

Despite reports that Samsung Electronics and LG Electronics are selling much larger volumes of flexible OLED applied Galaxy S6 Edge and OLED TV respectively compared to last year, the OLED material market is gradually stagnating.

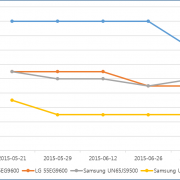

The main reason for this OLED material market’s downward turn is Samsung Display’s operation level which remained stationary at 50% in H1. This led to stationary material usage compared to the year before. LG Display is producing flexible OLED and large size OLED panel for TV. However, approximately only 100,000 units of OLED panels were sold in H1 and material usage was also lowl. The current capa. is 34K but as the OLED material cost spent in H1 is approximately US$ 36 million, the operation rate is analyzed to be only 30% of the total capa.

The OLED material market is decreasing because the supply price is rapidly falling without increase in production volume. OLED material companies are frustrated at the 10-15% price decrease per quarter. At present, as the only clients are Samsung Display and LG Display, material companies are compelled to reduce the price as the failure to do so could lead toward the termination of business. OLED material companies spend several thousands of millions of dollars annually on development to meet constant improvement demanded by clients. There is much difficulty for OLED material companies as display companies continue with one-sided demands without compensation regarding development cost.

For OLED industry to maintain its continued growth, it requires more than success of panel companies. Material companies that play a pivotal part within the industry have to continue development and production of quality materials in order to create a healthy growth cycle. However, display companies are destroying the ecosystem.

What OLED material companies currently crave is for Chinese display companies to mass produce OLED panels as soon as possible.

* 1 USD = 1,100 KRW