According to the LG Chemicals, it is about to take over the market as developing the OLED lighting to the level high enough to compete with LED for the first time in the world. In this context, the LG Chemicals announced the release of efficient and durable OLED lighting panel beginning from November.

Having the light efficiency of 100lm/W and long durability of 40,000 hrs., the OLED lighting panel that the LG Chemicals has developed this time is compatible not only with the fluorescent light (100lm/W, 20,000 hrs.) but also with LED light (Above 100lm/W, 50,000 hrs.). In particular, this technological development of the LG Chemicals is evaluated outstanding compared to the OLED lighting panel of major lighting companies with the efficiency of 60lm/W.

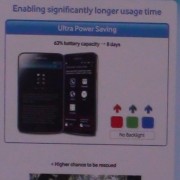

OLED lighting is the only light source in the form of plane, taking the center stage as ‘ecofriendly lighting’ which will lead the future lighting market for the features such as no dazzling or heat emission, and heavy metals like led, mercury, etc. While the LED lighting requires additional materials like a light guide panel, a heat sinking plane, and a lampshade when manufacturing a light equipment, the OLED needs no elements, ultimately saving the production cost. In addition, it is easy to install and its application range is divers as the thickness is 1/10 of LED and the weight is only 1/5 which could be another distinguishing property against other light sources.

In an attempt to popularized OLED light which has many merits as mentioned above, the LG Chemicals realized the technology to enhance user convenience and improved cost structure. First, it has completed the development of the ‘OLED lighting engine’ which is a module type product that anyone can use by plugging in and it is expected to be mass produced in the future.

* OLED lighting engine: Modulized product combining the OLED lighting panel with operation driver.

In addition, it is anticipated to be supplied with the price similar to LED when mass produced by applying differentiated OLED materials and improving the yielding rate. LG Chemicals plans to focus its business on the two primary lighting markets of North America and Europe with its distinguishing technologies.

To this end, LG Chemicals is devoted to build main global customers first, currently secured more than 50 companies including the biggest American lighting company like Acuity. Furthermore, it is planning to go into the automobile light markets which takes up to 20% of the entire lighting market for the expansion of OLED lighting application fields.

With a wide range of design applicability of recent OLED, it is favored in the automotive lighting apparatus markets and to go along with this trend, LG Chemicals is developing an automotive taillight applying the OLED lighting panel in cooperation with global automobile corporations in Europe, Japan, etc., intended to mass-produce in 2017.

Park Young-ki, the President of LG Chemicals said that “There is a large market potential for OLED lighting as it has many merits like quality lights, ease of installation, etc. different from the existing lightings” and added “The plan is to promote the lighting through the continuous R&D and mass-production investment equipped with our world class technology.”

According to the UBI Research, the market research company, the OLED lighting panel market is expected to record the drastic average annual growth of more than 100%, opening from the 2015 and reaching about 550 billion won in 2016 and 4.8 trillion won in 2020.

reporter@olednet.co.kr